Accommodation and Food Services - Economics and Employment

Explore the Accommodation and Food Services (A&FS) industry data which highlights its contribution to the local economy on the Sunshine Coast.

Explore the Accommodation and Food Services (A&FS) industry data which highlights its contribution to the local economy on the Sunshine Coast. Within this sector, businesses offer short-term lodging and food services, catering to travellers and locals. From cozy inns to bustling eateries, the industry has played a vital role in the region’s development and exposure to markets outside of region.

This analysis looks at key factors like employment trends, economic output, and job vacancies to highlight the industry’s role in the local economy. By focusing on these measures, stakeholders can gain valuable insights into the current position and industry trends while understanding the broader economic landscape.

Data sourced for this article is the most recent information made available by the Australian Bureau of Statistics (ABS) and National Institute of Economic and Industry Research (NIEIR).

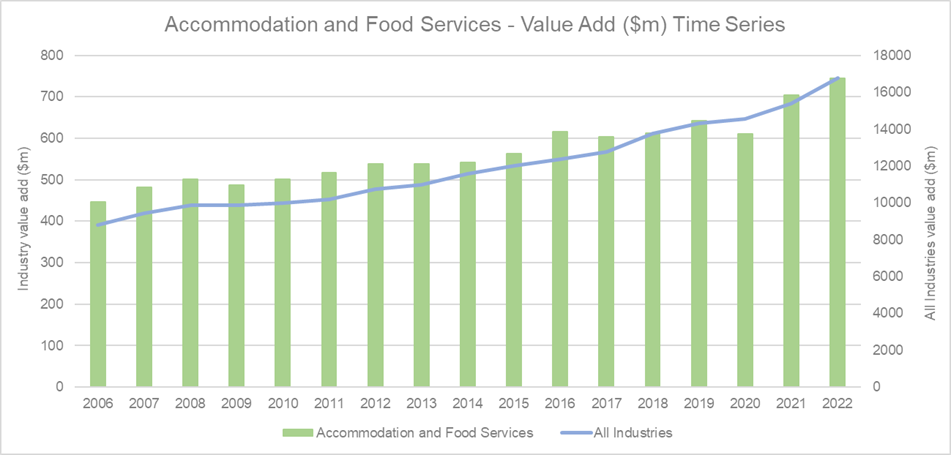

Industry productivity

Source: National Institute of Economic and Industry Research (NIEIR) 2023. Compiled and presented by economy.id

Here we find the value add by A&FS which indicates productivity based on how effective businesses can increase the value of its inputs. Over the past 16 years, value added in this industry and the total for all industries has steadily increased with this growth becoming more significant since 2019. In 2022, the industry reached its highest value add peak of $745 million demonstrating local business’ ability to deliver for customers when COVID-19 restrictions loosened. Represented by the blue line, A&FS productivity grew in line with the industry combined average on the Sunshine Coast. A&FS productivity remained higher than the Sunshine Coast industry average prior to 2018. Investment in high-value industries and skills development led to the Sunshine Coast experiencing productivity growth across the board after 2017.

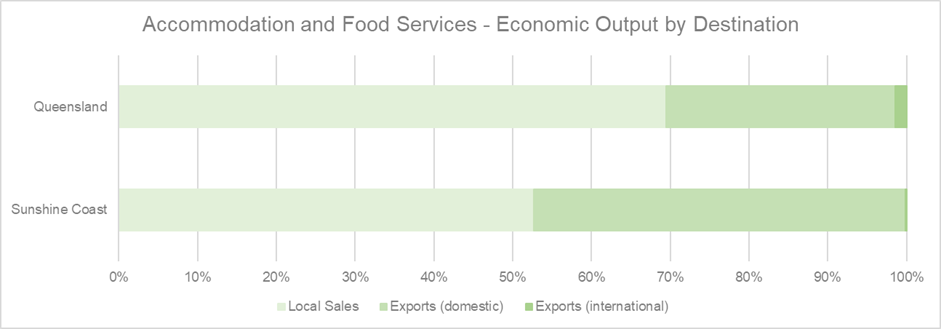

Export and local sales

(Source: National Institute of Economic and Industry Research (NIEIR) 2023. Compiled and presented by economy.id)

Data from export (domestic and international) and local sales demonstrates the distribution of economic output by A&FS in comparison to Queensland. In 2022, 52.6 per cent of economic output on the Sunshine Coast came from local sales. While 47.2 per cent of economic output came from domestic exports. International exports made up a very slight percentage for Queensland and the Sunshine Coast. This indicates the impacts of international border restrictions at the time, and the eagerness of people wanting to explore other region’s post-lockdowns.

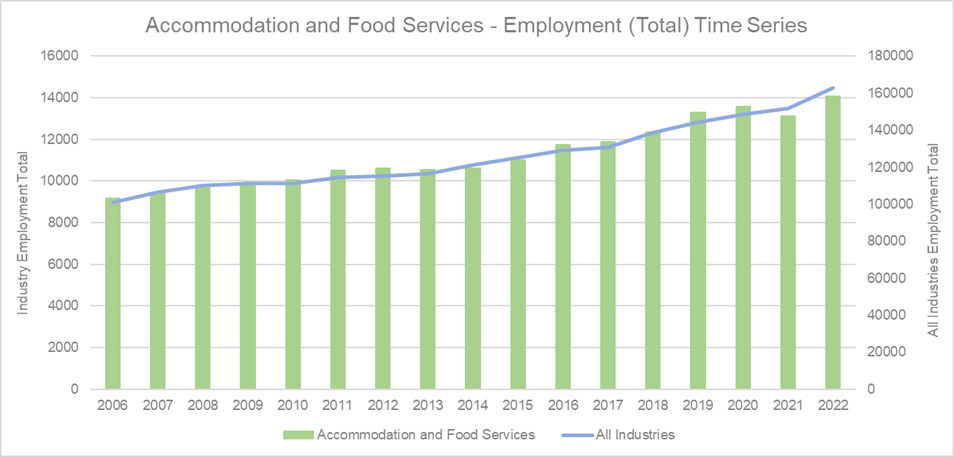

Total employment time series

Source: National Institute of Economic and Industry Research (NIEIR) 2023. Compiled and presented by economy.id

Over the past 16 years as shown in the graph, employment in this industry and the total for all industries has steadily grown in the Sunshine Coast. In 2022, employment in A&FS quickly bounced back to levels higher than previously experienced. Over 14,000 employees were recorded in A&FS in 2022, while total employees across all industries on the Sunshine Coast reached over 162,000. Economic output data (previously mentioned) indicates that the quick employment resurgence helped accommodate locals and people visiting from outside of region.

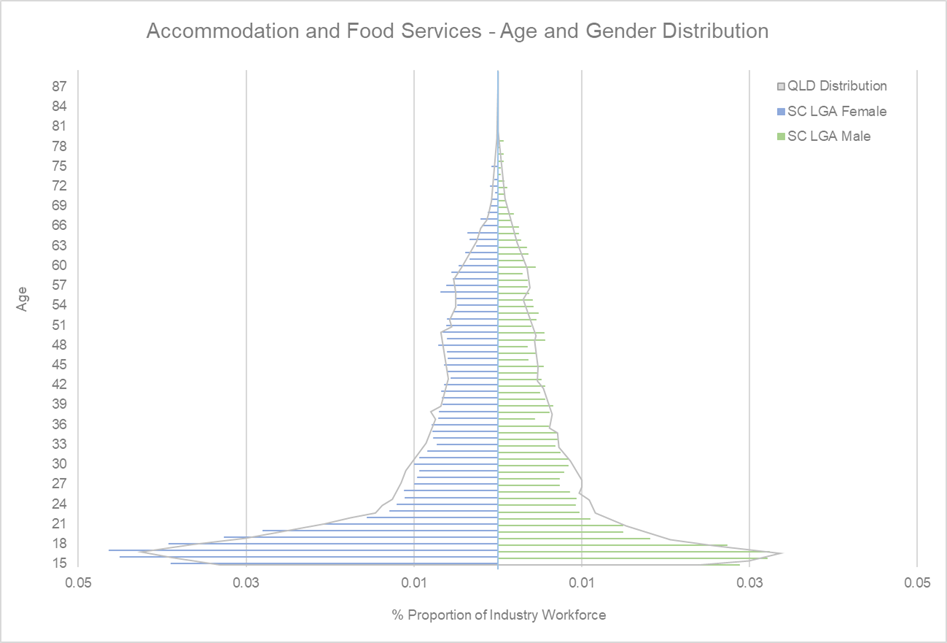

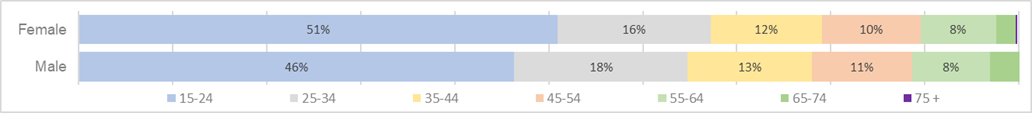

Employee age and gender distribution

(Source: ABS Table Builder 2024, 2021 Census - employment, income, and education)

Data indicates that the gender distribution in A&FS skews higher towards females at 57 per cent with males making up 43 per cent of the workforce. This is proportional with Queensland equalling close to the same age distribution. Ages 15 to 24 years make up majority of A&FS employees with 51 per cent of females and 46 per cent of males in the industry’s workforce falling within that age bracket.

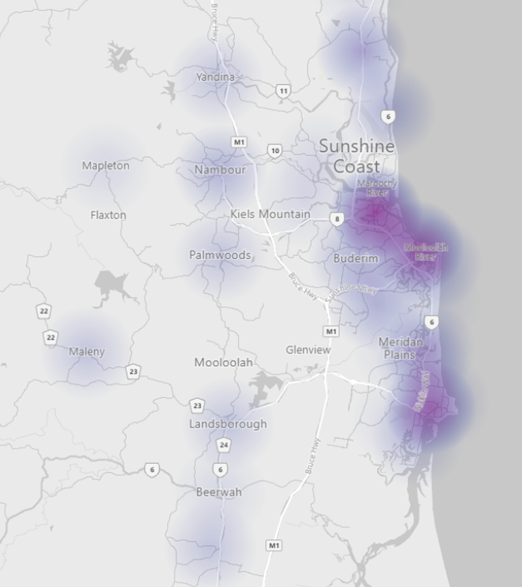

Employee place of work distribution

(Source: ABS Table Builder 2024, 2021 Census - employment, income, and education)

The above heat map provides an illustration of the workplace distribution across the Sunshine Coast. No surprise that much activity takes place from Maroochydore down to Caloundra. Accommodation and food service businesses have catered for the densely populated, tourist areas of the coast. Hinterland towns provide an array of unique accommodation and food experiences allowing residents and visitors to find diversity in the region.

Disclaimer: ABS employment Data has this information grouped by larger selected suburbs. Smaller suburbs feed into the data set of these selected suburbs.

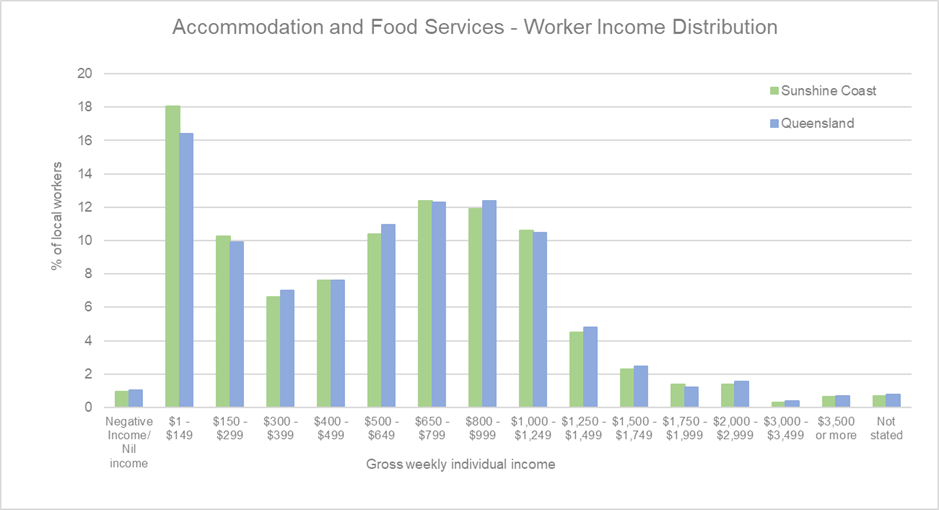

Employee income distribution

(Source: Australian Bureau of Statistics, Census of Population and Housing 2021. Compiled and presented by economy.id)

Income distribution for employees on the Sunshine Coast is relatively in line with the Queensland distribution. The median weekly personal income on the Sunshine Coast is $750 (ABS Census 2021) which we can see most of the A&FS distribution falls under. Contributing factors to this would be the young employee age demographic as stated earlier, and 54.1 per cent of employees without qualifications due to the nature of the work (ABS census 2021).

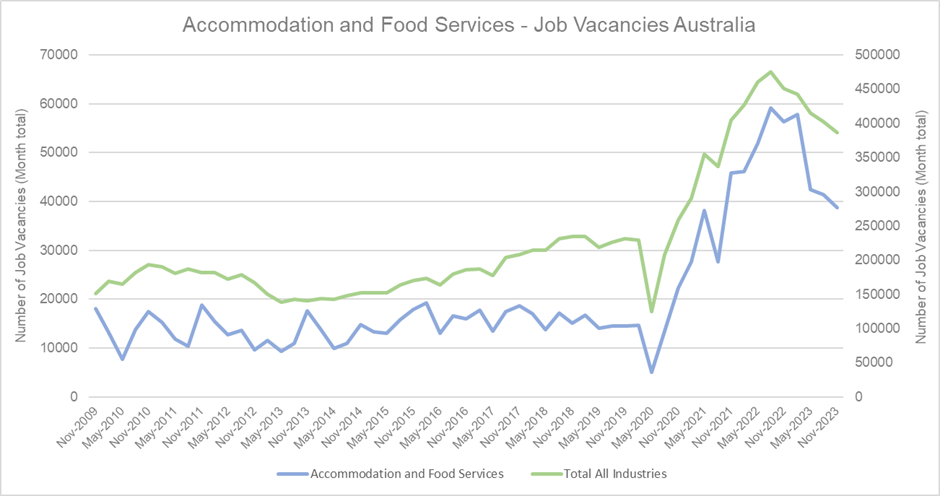

Job vacancies – Australia-wide

(Source: ABS 2024, Time Series – 6354 – Job Vacancies, Industry, Australia)

Across Australia’s A&FS industry we’ve seen job vacancy levels dip as international workers re-enter Australia. All other industries are experiencing similar trends as more job seekers become available and employers seek new solutions to deal with the lack of labour availability.

Conclusion

The A&FS industry on the Sunshine Coast emerges as a cornerstone of the local economy, embodying both resilience and adaptability. Through analysis of employment trends, economic output, and productivity growth, it becomes evident that A&FS businesses play a crucial role in driving regional development and exposure to broader markets. Data sourced underscores the industry's contribution, particularly highlighted by its highest value add peak of $745 million in 2022. The industry's ability to rebound from challenges such as COVID-19 restrictions demonstrate its importance in servicing locals and visitors. The sector's workforce composition, workplace distribution, and income distribution shed light on its demographic nuances and economic impact. Ultimately, the A&FS industry stands as a vital engine of economic vitality and cultural diversity on the Sunshine Coast, poised to shape its trajectory for years to come.

Resources and support

Disclaimer

Information contained in this correspondence is based on available information at the time of writing. All figures and diagrams are indicative only and should be referred to as such. While the Sunshine Coast Regional Council has exercised reasonable care in preparing this information it does not warrant or represent that it is accurate or complete. Council, its officers, and contractors accept no responsibility for any loss occasioned to any person acting or refraining from acting in reliance upon any material contained in this document. Any forecasts or projections used in the analysis can be affected by a number of unforeseen variables, and as such no warranty is given that a particular set of results will in fact be achieved. Sunshine Coast Regional Council has referenced a range of data sources to compile this information including the Australian Bureau of Statistics, Queensland Government Statistician’s Office, Tourism Research Australia, Economy Id and the National Institute of Economic and Industry Research. While every care has been taken to ensure the content is accurate, there may be errors or omissions in it and no legal responsibility is accepted for the information.