Arts and Recreation Services - Economics and Employment

Explore the Arts and Recreation Services sector data which highlights its contribution to the local economy on the Sunshine Coast.

The Arts and Recreation Services industry on the Sunshine Coast is embedded in the region’s economic and cultural identity, showcasing local talent, and providing memorable experiences to residents and visitors. In recent years the sector has experienced remarkable growth which has significantly contributed to the local economy. This article provides a comprehensive data-driven analysis of the industry’s historical performance and current position.

The sector has seen a substantial increase in value add over the past five years, particularly following COVID-19 restrictions relaxing which has allowed for a resurgence in activities, events, and visitor engagement. Net migration to the Sunshine Coast from other states has further amplified the demand for arts and recreation experiences. This surge, coupled with high participation in events like major sport events and local music festivals has positioned the Sunshine Coast as a key player in Queensland’s arts and recreation sector.

The arts and recreation sector covers several emerging industries that have been highlighted in the Sunshine Coast Regional Economic Development Strategy (REDS) 2023. Industries including music and creative industries and major events and sport are industries that will support the region in diversifying the economy and job opportunities. All the while expanding the culture and leisure experiences in the region.

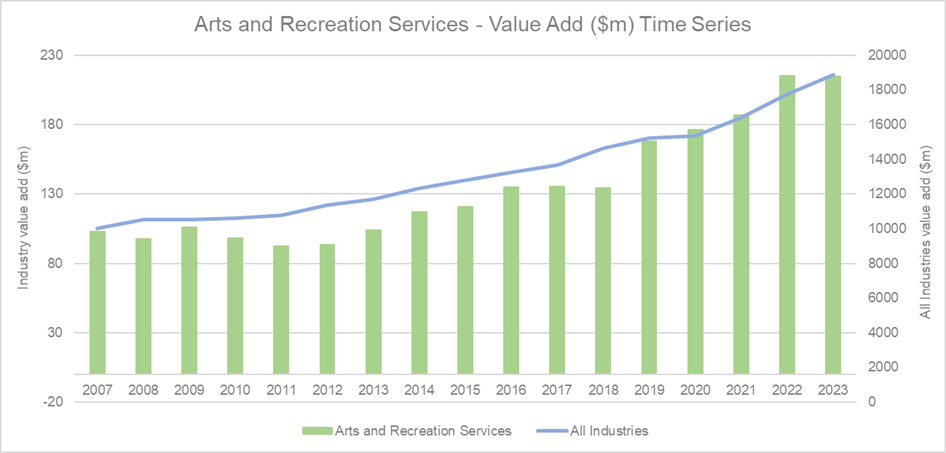

Industry productivity

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Value add in the arts and recreation sector on the Sunshine Coast has grown considerably in the last five years. In 2022 the industry outpaced the trend of all other industries with a significant value add jump of 15.2 per cent on the previous year. The productivity increase could be contributed to the relaxed COVID-19 restrictions which allowed residents and visitors to participate in more activities. The Sunshine Coast also experienced a considerable net migration from other states and regions which created more demand for arts and recreation. From 2007 to 2018 the sector’s value add increased gradually by 30.1 per cent but then well and truly exceeded that from 2018 onwards, jumping by 59.8 per cent. Value add is the net output of a sector once all inputs have been factored in.

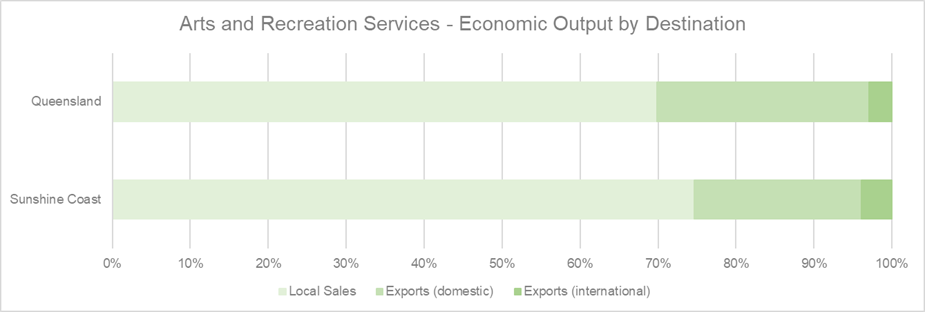

Export and local sales

(Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id)

Arts and recreation on the Sunshine Coast play a vital role in showcasing the region to domestic and international visitors. Events such as the Mooloolaba Triathlon and local music festivals attracts interregional participation and has contributed to the recent growth in the sector over the last five years. Sunshine Coast exports in the sector play an important role in the state’s overall exports which contributed 5.9 per cent in the 2022/23 financial year. Local demand for arts and recreation services is higher compared to Queensland with local sales making up 74.6 per cent of total output. International markets do make up a larger portion of sales next to the state with 3.9 per cent of sales attributed to those visitors.

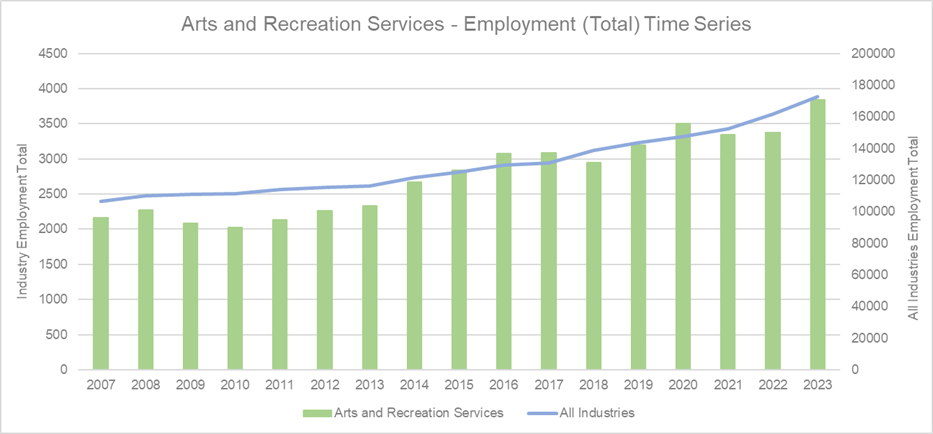

Total employment time series

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Employment opportunities in arts and recreation has maintained a similar trend to all other industries having grown gradually from 2014. In 2022/23 the Sunshine Coast’s total employment in the sector contributed 8.3 per cent to the state’s total arts and recreation workforce. The 2,703 local jobs made up 2 per cent of the total Sunshine Coast workforce across all industries.

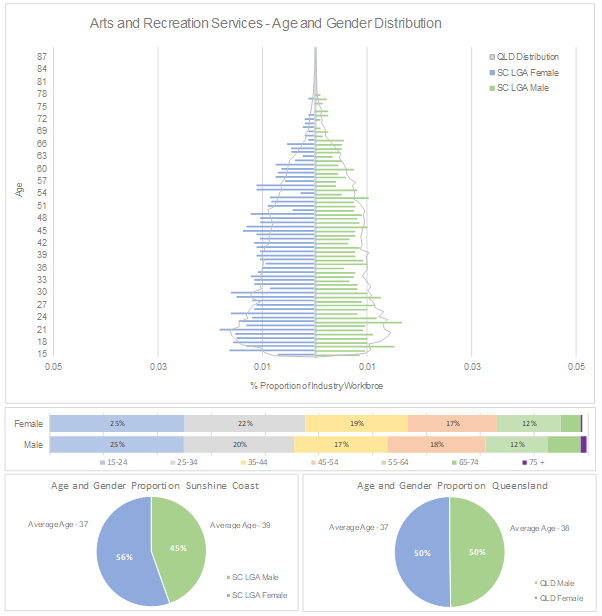

Employee age and gender distribution

(Source: ABS Table Builder 2024, 2021 Census - employment, income, and education)

Workers in the Sunshine Coast’s arts and recreation sector are widely spread across age brackets from 15 to 74. 15- to 24-year-olds are more heavily weighted, consisting of 25 per cent of the workforce, followed by 25- to 34-year-olds with 21 per cent. This is relatively consistent with the Queensland distribution although we can see spikes on the female side of the graph. This translates in the pie chart which indicates that 56 per cent of the sector’s workforce are female compared to 50 per cent across the state.

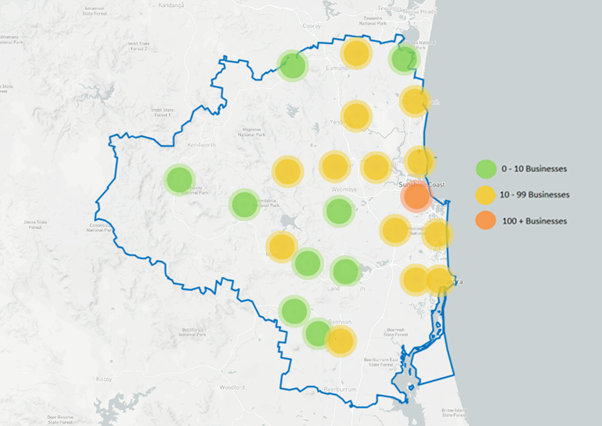

Industry business distribution

(Source: ABR 2024)

The above heat map illustrates the distribution of arts and recreation businesses across the Sunshine Coast. Understandably Maroochydore is home to the highest concentration of businesses, but we also see this expand further inland. Areas like Eumundi, Yandina, Nambour and Maleny have reputations of being locations with thriving arts scenes which is visual above.

Disclaimer: ABS employment Data has this information grouped by larger selected suburbs. Smaller suburbs feed into the data set of these selected suburbs.

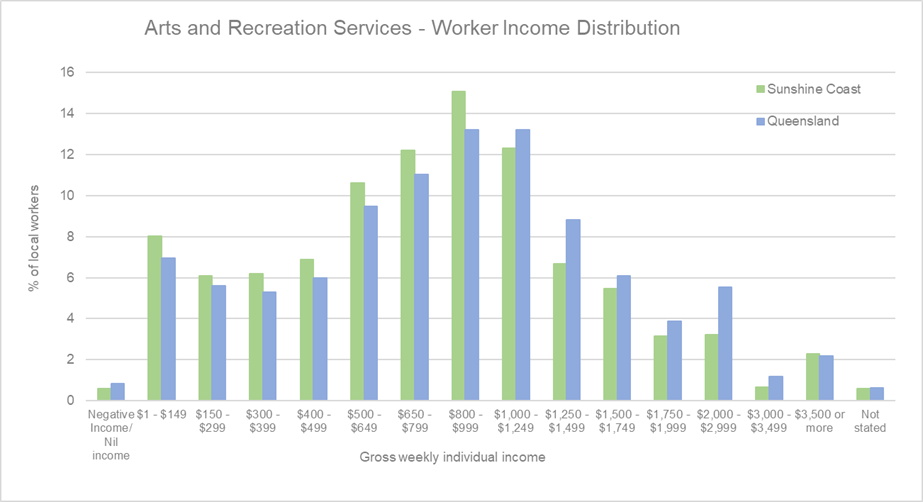

Employee income distribution

(Source: Australian Bureau of Statistics, Census of Population and Housing 2021. Compiled and presented by economy.id)

Income for workers in arts and recreation sits in the lower to mid-range of the income distribution spectrum. 50.3 per cent of local workers in the sector receive a weekly income of zero to $799. To put that into perspective, Sunshine Coast residents earn $750 per week on average across all industries (ABS Census 2022). The highest concentration is in the $800 to $999 bracket with 15.1 per cent of workers taking home a weekly income in that range.

Arts and recreation jobs are less inclined to require a qualification with 54.1 per cent of Sunshine Coast workers in the sector not holding a qualification. 29.6 per cent of local workers have a Certificate III or higher.

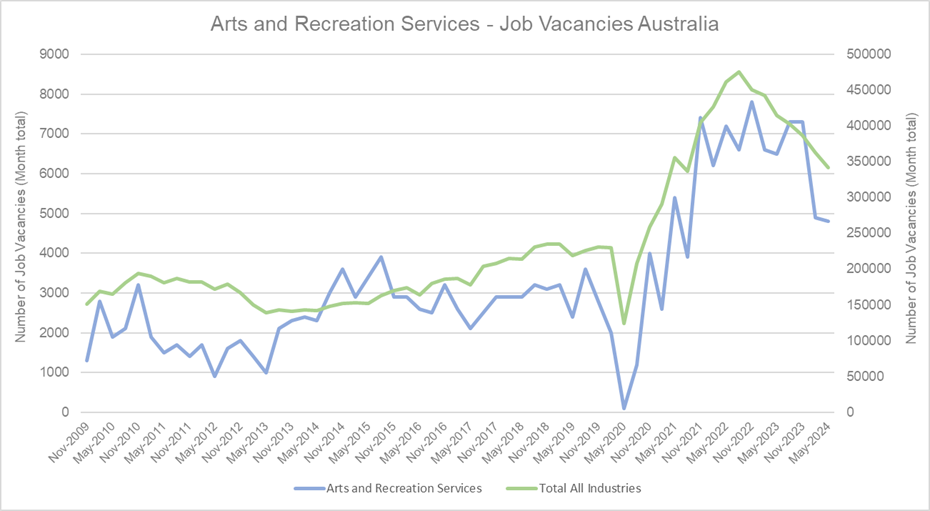

Job vacancies – Australia-wide

(Source: ABS 2024, Time Series – 6354 – Job Vacancies, Industry, Australia)

The Job vacancy level in the arts and recreation sector has followed a similar trend to the cumulative vacancy total across all industries. Vacancies in the sector have dropped off drastically since late 2023 indicating that labour demands are being met.

Conclusion

The Sunshine Coast’s Arts and Recreation Services industry has proven to be a dynamic and growing sector which has contributed significantly to the local economy and cultural fabric. The data reveals that local businesses have benefited from growing demand for arts and recreation experiences in the region. This has led to job opportunities that support local and state economies.

Looking ahead, the continued growth of the Sunshine Coast’s population and the increasing popularity of regional events present opportunities for sustained expansion. However, challenges such as income disparity and the lower qualification levels among workers in the sector need to be addressed to ensure long-term stability and wage growth.

For local businesses and stakeholders, understanding these trends will be valuable in navigating the evolving landscape. Understanding how the sector aligns with the Regional Economic Development Strategy (REDS) 2023 paints a picture of the Sunshine Coast and its vision for a healthy, smart and creative region.

Resources and support

- Connect with local Chambers and Industry Groups

- Sunshine Coast Jobs Hub

- Workforce Evolve

- Level Up Your Business

Disclaimer

Information contained in this correspondence is based on available information at the time of writing. All figures and diagrams are indicative only and should be referred to as such. While the Sunshine Coast Regional Council has exercised reasonable care in preparing this information it does not warrant or represent that it is accurate or complete. Council, its officers, and contractors accept no responsibility for any loss occasioned to any person acting or refraining from acting in reliance upon any material contained in this document. Any forecasts or projections used in the analysis can be affected by a number of unforeseen variables, and as such no warranty is given that a particular set of results will in fact be achieved. Sunshine Coast Regional Council has referenced a range of data sources to compile this information including the Australian Bureau of Statistics, Queensland Government Statistician’s Office, Tourism Research Australia, Economy Id and the National Institute of Economic and Industry Research. While every care has been taken to ensure the content is accurate, there may be errors or omissions in it and no legal responsibility is accepted for the information.