Health Care & Social Assistance, Economics and Employment

Explore the Health Care and Social Assistance sector data which highlights its contribution to the local economy on the Sunshine Coast.

The Health Care and Social Assistance (HCSA) sector has formed part of the foundation of Sunshine Coast's economy and has rapidly grown in line with the population. This sector plays a significant role in the local economy, driven by major developments such as the opening of the Sunshine Coast University Hospital in 2017 which has strengthened the region’s position as a healthcare hub. The workforce in this industry is highly skilled with a large proportion holding advanced qualifications which reflects the specialised nature of the jobs. Employment has grown substantially in recent years as roles such as Personal Carers, Assistants, Midwifery, and Nursing Professionals play key roles in the workforce. As the Sunshine Coast continues to grow, the HCSA sector is well-positioned to expand its impact, supporting not only the local population but also surrounding areas. With strong foundations and increasing demand, the industry remains a vital driver of the Sunshine Coast’s economic and community well-being.

HCSA was highlighted in the recent refresh (2023) of the Sunshine Coast Regional Economic Development Strategy (REDS) 2013 - 2033. The industry will play a vital role in helping the region achieve four key economic outcomes which includes growing the local Gross Regional Product to $33 billion. Highlighted in the REDS is the talent and skills pathway that addresses talent attraction, retention and development which is desperately needed by the construction industry. Sunshine Coast Council will work with other government agencies and industry to support this pathway.

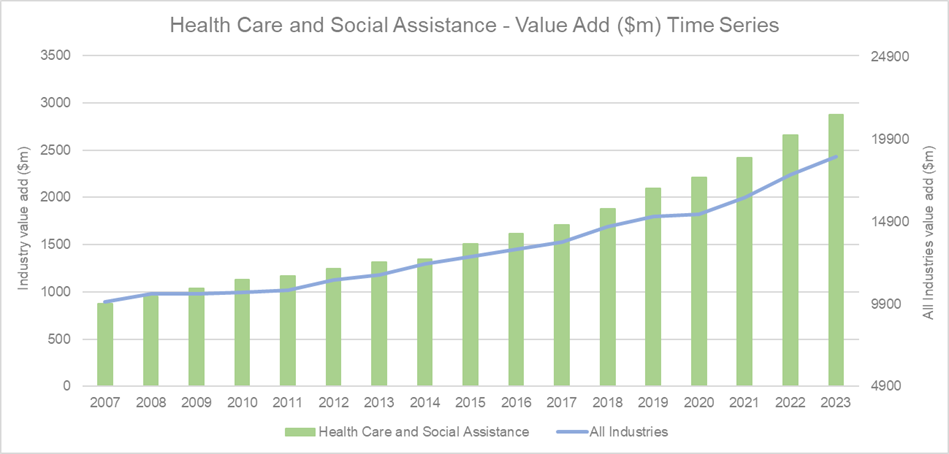

Industry productivity

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

As population growth on the Sunshine Coast increased dramatically, also did the Health Care and Social Assistance (HCSA) sector. The demand on the sector to care for the growing population resulted in the industry growing to 15.3 per cent of the region’s value add, totalling $2.8 billion in 2022/23. This is an 8.1 per cent value add growth from 2022 to 2023. We can see illustrated above by the blue line that HCSA value add has far outpaced all other industries on the Sunshine Coast significantly. The opening of the Sunshine Coast University Hospital in 2017 helped support the growth of the sector on the Sunshine Coast.

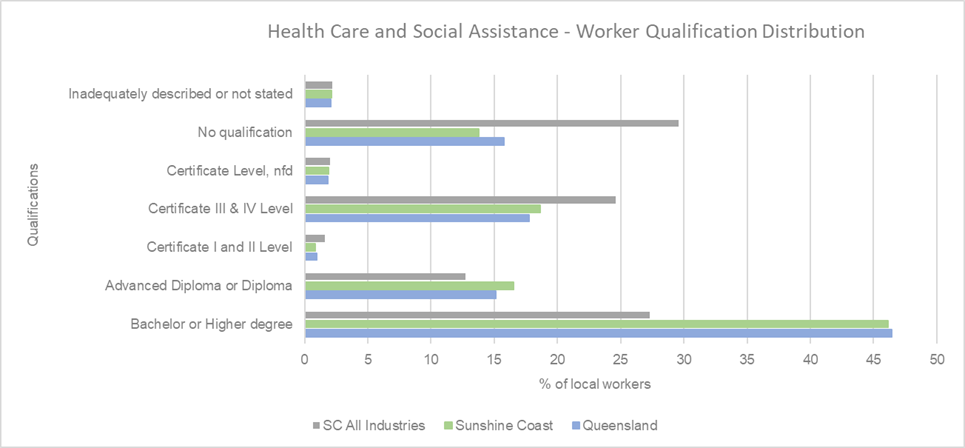

Industry workers qualifications

Source: Australian Bureau of Statistics, Census of Population and Housing 2021. Compiled and presented by economy.id)

The above graph shows the level of education found in the Health Care and Social Assistance (HCSA) workforce on the Sunshine Coast and Queensland. 46.1 per cent of the local sector’s workforce have obtained a qualification at a Bachelor level or higher which indicates the specialist skill required for jobs in the industry. 83.9 per cent of workers hold a form of qualification making it one of the highest qualified sectors on the Sunshine Coast and across Australia. Across all qualification levels, we see that the Sunshine Coast is relatively on par with the rest of the state.

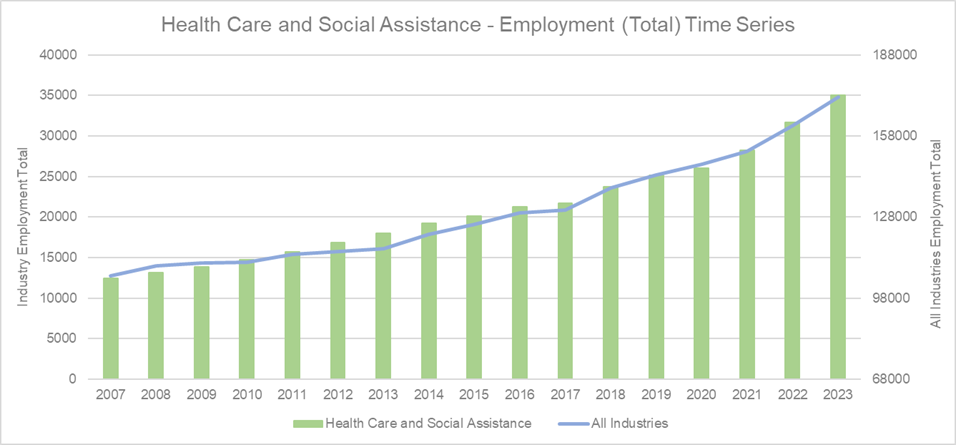

Total employment time series

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Total jobs in Health Care and Social Assistance (HCSA) have remained relatively in line with all industries on the Sunshine Coast. The growth of HCSA jobs have grown substantially over the past four years. Since 2020, total jobs in the local sector have grown by 34.8 per cent compared to 19.5 per cent growth in the previous four years. Personal Carers and Assistance jobs are the highest employing at 20.3 per cent of the workforce followed by Midwifery and Nursing Professionals at 17.3 per cent.

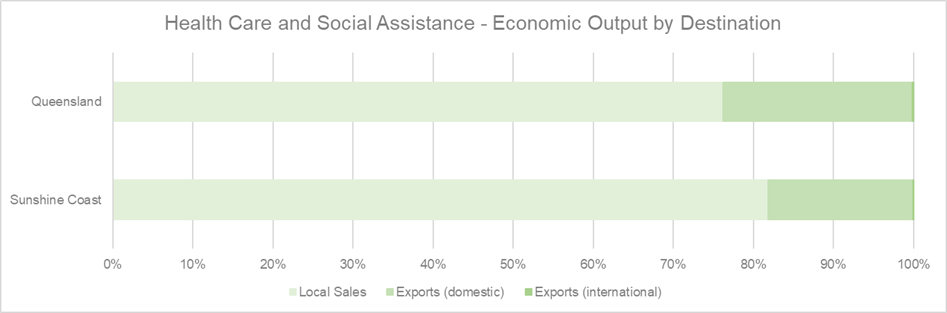

Export and local sales

(Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id)

Local sales make up 81 per cent of output for the local Health Care and Social Assistance (HCSA) sector while domestic exports contribute 17.8 per cent. The Sunshine Coast is a regional hub that’s home to a highly regarded university hospital which services patients from surrounding areas. HCSA sales totalled $4.1 billion in 2022/23 making up 7.6 per cent of the state’s total sales for the year.

The Sunshine Coast Regional Economic Development Strategy (2013-2033) sets out the region’s intention to build export opportunities to benefit local goods and services sectors with ambition of reaching 20 per cent of total output exported by 2033. In 2022, exports reached 18 per cent of output making that 2033 target well within reach.

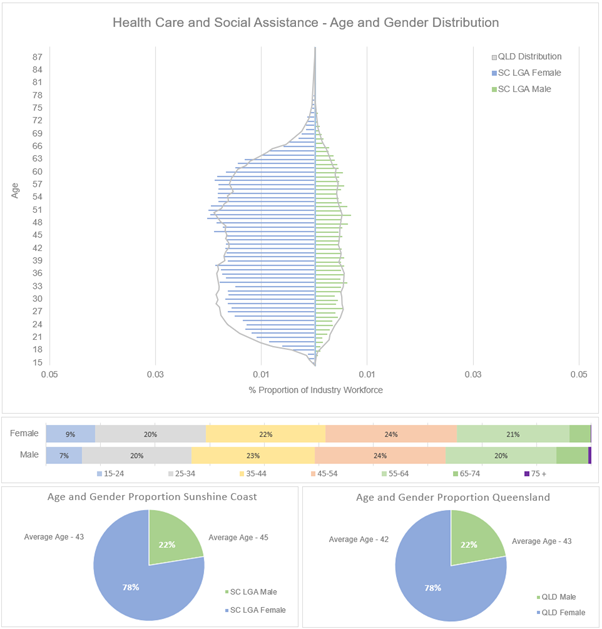

Employee age and gender distribution

(Source: ABS Table Builder 2024, 2021 Census - employment, income, and education)

Females contribute to a significant percentage of the sector’s workforce making up 78 per cent of staff with the average age sitting at 45 years old. According to the 2021 Census, 20,360 females were employed in the Health Care and Social Assistance workforce compared to 5,912 males. 30.6 per cent of that workforce were born overseas which indicates the diversity that the sector fosters.

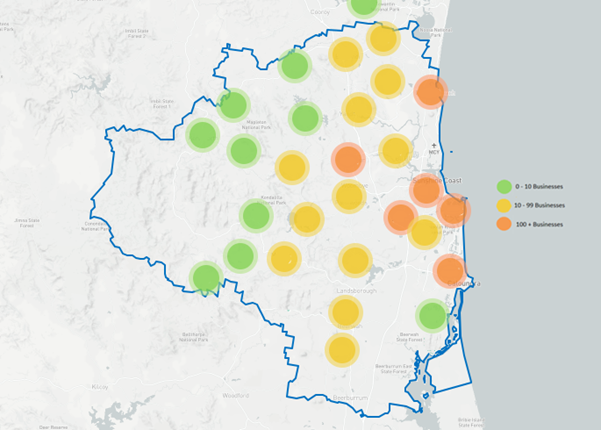

Industry business distribution

(Source: ABR 2024)

The above heatmap illustrates the distribution of Health Care and Social Assistance businesses on the Sunshine Coast. Businesses are densely populated along coastal areas and out to inner hinterland towns such as Nambour. The region is currently home to approximately 3,000 businesses that make up the Sunshine Coast’s 36,000 business community.

Disclaimer: ABS employment Data has this information grouped by larger selected suburbs. Smaller suburbs feed into the data set of these selected suburbs.

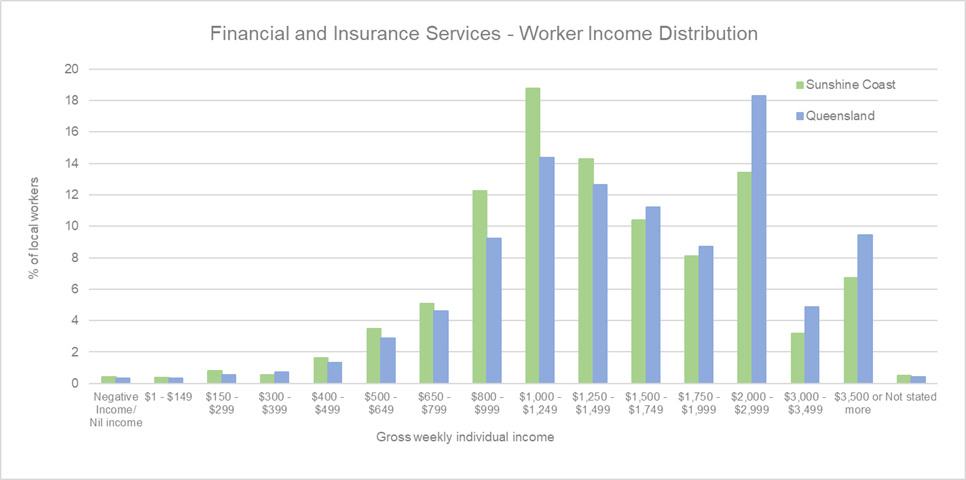

Employee income distribution

(Source: Australian Bureau of Statistics, Census of Population and Housing 2021. Compiled and presented by economy.id)

Wages in the local Health Care and Social Assistance (HCSA) industry is higher than the Sunshine Coast average ($750 per week) with 73 per cent of the local industry making over $800. The largest income bracket for this sector is $1000-$1,249 which is represented by 15.2 per cent of the local workforce.

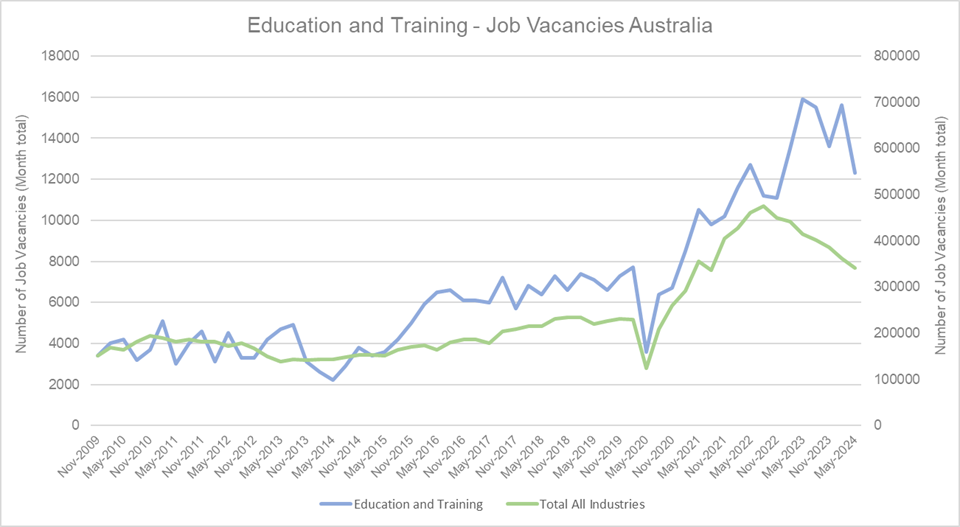

Job vacancies - Australia-wide

(Source: ABS 2024, Time Series – 6354 – Job Vacancies, Industry, Australia)

Job vacancies in the Health Care and Social Assistance (HCSA) across Australia spiked dramatically higher than all industries since early 2020. This spike can be contributed to the pandemic placing large demand on nurses and health professionals. Despite the end of the pandemic, job vacancy levels have remained high.

Conclusion

The Health Care and Social Assistance (HCSA) sector is integral to the Sunshine Coast’s economy and community, underpinned by its skilled workforce, diverse employment opportunities, and critical role in supporting a growing population. The sector’s substantial contributions to the region’s value add and employment growth highlights its position as a cornerstone of local development. Beyond its economic impact, the HCSA sector also fosters inclusivity and diversity. Local businesses spread across coastal and hinterland areas further enhance the accessibility and reach of healthcare services to ensure that residents and surrounding communities receive vital support. Looking ahead, the HCSA sector is poised for continued growth. By leveraging strong foundations, increasing demand, and strategic regional plans like the Sunshine Coast Regional Economic Development Strategy, the industry is well-positioned to expand its services, exports, and workforce capacity. As the Sunshine Coast evolves, the HCSA sector will remain a vital driver of economic resilience, social well-being, and innovation, securing its place as one of the region’s most dynamic and essential industries.

Resources and support

- Connect with local Chambers and Industry Groups

- Sunshine Coast Jobs Hub

- Workforce Evolve

- Level Up Your Business

- Sunshine Coast Regional Jobs Committee

Disclaimer

Information contained in this correspondence is based on available information at the time of writing. All figures and diagrams are indicative only and should be referred to as such. While the Sunshine Coast Regional Council has exercised reasonable care in preparing this information it does not warrant or represent that it is accurate or complete. Council, its officers, and contractors accept no responsibility for any loss occasioned to any person acting or refraining from acting in reliance upon any material contained in this document. Any forecasts or projections used in the analysis can be affected by a number of unforeseen variables, and as such no warranty is given that a particular set of results will in fact be achieved. Sunshine Coast Regional Council has referenced a range of data sources to compile this information including the Australian Bureau of Statistics, Queensland Government Statistician’s Office, Tourism Research Australia, Economy Id and the National Institute of Economic and Industry Research. While every care has been taken to ensure the content is accurate, there may be errors or omissions in it and no legal responsibility is accepted for the information.