Manufacturing - Economics and Employment

Explore the manufacturing industry data which highlights its contribution to the local economy on the Sunshine Coast.

This industry analysis of the Sunshine Coast’s manufacturing sector highlights the importance of the industry in the Sunshine Coast economy. The Sunshine Coast Regional Economic Development Strategy (2013-2033) Refresh (REDS) prioritises the local Production Economy as one of six economies that will drive sustainable growth and prosperity in the region. Technology, innovation and skills development and attraction in the sector will play a vital role in growing the industry.

Data sourced from the Australian Bureau of Statistics (ABS) and the National Institute of Economic and Industry Research (NEIR) delves into insights such as industry productivity, economic output and employment. This helps to paint the picture of manufacturing on the Sunshine Coast. By focusing on these measures, stakeholders can gain valuable insights into the current position and industry trends while understanding the broader economic landscape.

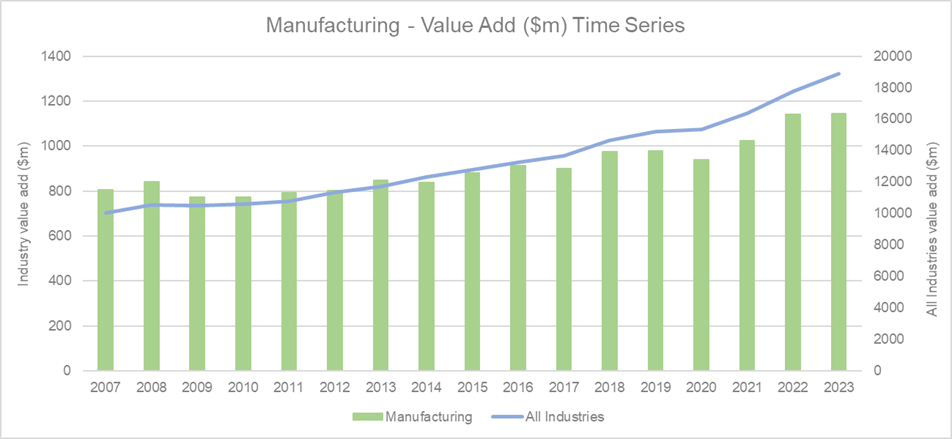

Industry productivity

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Prior to 2020, the Sunshine Coast’s manufacturing sector had been maintaining consistent value add annually ranging from $772 million to $977 million. The sector then experienced an increase in productivity in 2022 and 2023 as advancements in technology and processes were invested into. 2023 marked the sector’s highest productivity level of $1.144 billion, marking a 21.7 percent increase since 2020. ‘Value Add’ is a measurement of productivity by calculating the value of inputs.

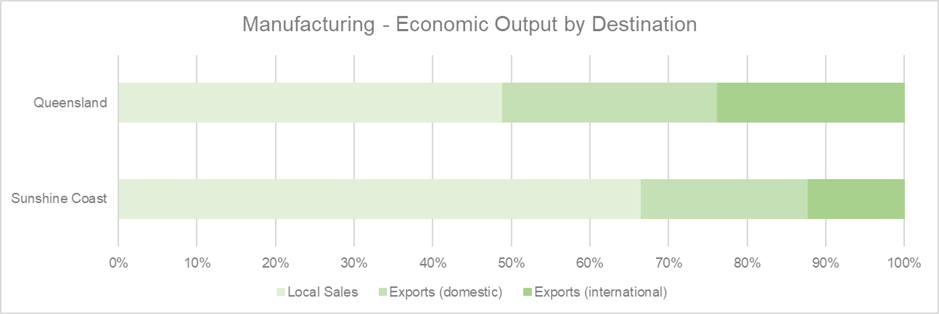

Export and local sales

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Economic output on the Sunshine Coast highlights the high level of locally made products being sold inside of the region. 66.5 per cent of locally made products are sold on the Sunshine Coast, 21.2 per cent are sold outside of region in Australia and 12.2 per cent are sold internationally. The Sunshine Coast Regional Economic Development Strategy (2013-2033) sets out the region’s intention to build export opportunities to benefit local goods and services sectors with ambition of reaching 20 per cent of total output exported by 2033.

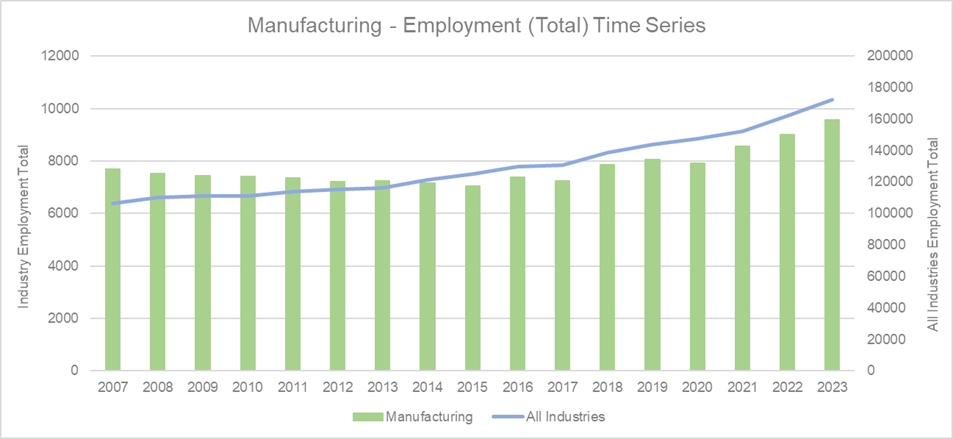

Total employment time series

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Employment in the Sunshine Coast’s manufacturing sector has increased year-on-year since 2017, with most of the increase occurring from 2020. Employment in manufacturing reached its highest level in 2023 of 9,572 jobs compared to its lowest point since 2015 of 7047 jobs. Consumer spending habits coming back onshore from 2020 helped increase demand for local manufacturing jobs. Growing industry and opportunity in the region has provided more job prospects for low and high skilled workers in the sector.

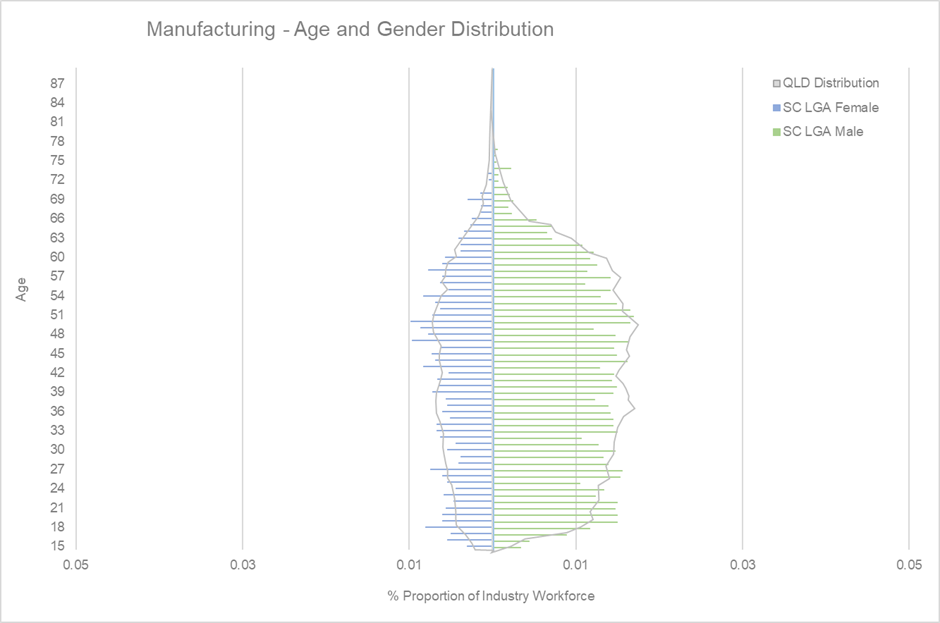

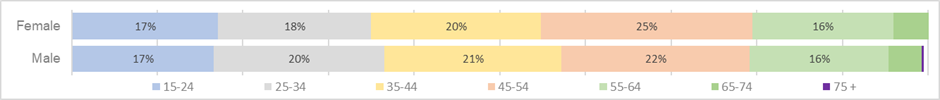

Employee age and gender distribution

(Source: ABS Table Builder 2024, 2021 Census - employment, income, and education)

Data indicates that the gender distribution of manufacturing workers skews heavily towards males. Males make up 69 per cent of the workforce on the Sunshine Coast with the average age being 41. Of the 31 per cent of females working in the manufacturing sector, 25 per cent of that workforce is aged between 45 and 54 years old. The Sunshine Coast age and gender distribution is comparatively similar to the state of Queensland.

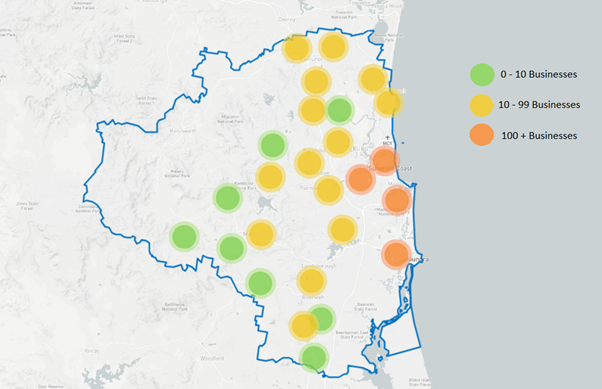

Employee place of work distribution

(Source: ABR 2024)

The above heat map provides an illustration of the workplace distribution across the Sunshine Coast. Industrial precincts along the coast spanning from Caloundra to Coolum Beach contains the majority of manufacturers in the region. Nambour and surrounds also homes a substantial number of manufacturing businesses.

Disclaimer: ABS employment Data has this information grouped by larger selected suburbs. Smaller suburbs feed into the data set of these selected suburbs.

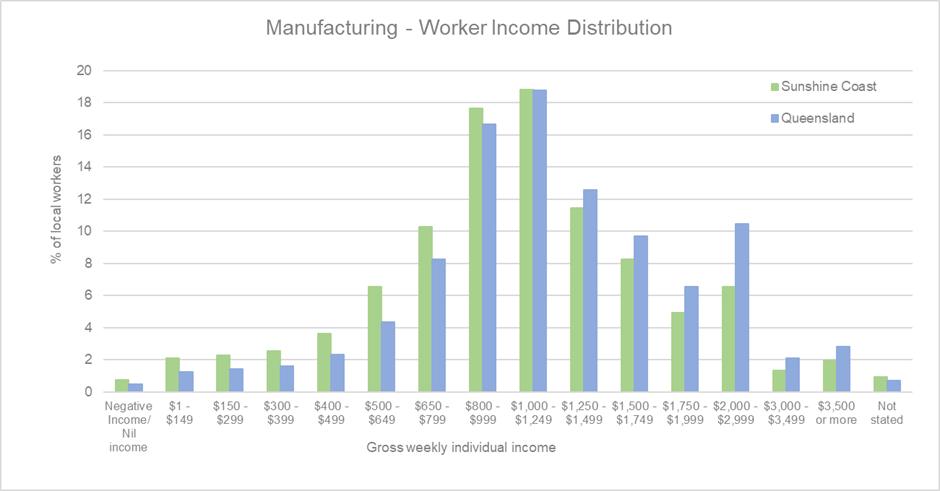

Employee income distribution

(Source: Australian Bureau of Statistics, Census of Population and Housing 2021. Compiled and presented by economy.id)

Workforce income in the manufacturing sector on the Sunshine Coast is comparably lower than the state of Queensland. This margin is expected to narrow in the coming years as the sector on the Sunshine Coast matures and more investment from new and existing business is spent inside of the region. The largest percentage of local manufacturing workers sit within the gross weekly income of $1,000 to $1,249. This bracket is higher than the average Sunshine Coast individual income of $750 per week (ABS Census 2021), demonstrating the industry’s evolution into one that seeks and trains high skilled workers.

Job vacancies – Australia-wide

(Source: ABS 2024, Time Series – 6354 – Job Vacancies, Industry, Australia)

Australia-wide, the manufacturing industry experienced a similar job vacancy trend as total of all industries. The sharp rise in vacancies from late 2020 through to late 2021 was driven by reopening industries after COVID-19 that required more staff to fill surging onshore demand.

Conclusion

The manufacturing sector on the Sunshine Coast plays a critical role in the region's economic landscape, as outlined by the Sunshine Coast Regional Economic Development Strategy (2013-2033). Technological advancements, innovation, and skills development are key to the sector's growth and sustainability. Data from the ABS and NEIR has provided valuable insights into the sector's productivity, economic output, and employment trends, highlighting a consistent increase in value added and workforce numbers. Local sales dominate the market, with a portion also sold nationally and internationally. Employment has surged since 2020, driven by increased local consumer demand. The sector is poised for continued growth, with strategic efforts aimed at boosting export opportunities and attracting further investment to enhance its contribution to the regional economy.

Resources and support

- Manufacturing Excellence Forum

- Food & Agribusiness Network

- Manufacturing visual database

- Sunshine Coast Jobs Hub

- Workforce Evolve

Disclaimer

Information contained in this correspondence is based on available information at the time of writing. All figures and diagrams are indicative only and should be referred to as such. While the Sunshine Coast Regional Council has exercised reasonable care in preparing this information it does not warrant or represent that it is accurate or complete. Council, its officers, and contractors accept no responsibility for any loss occasioned to any person acting or refraining from acting in reliance upon any material contained in this document. Any forecasts or projections used in the analysis can be affected by a number of unforeseen variables, and as such no warranty is given that a particular set of results will in fact be achieved. Sunshine Coast Regional Council has referenced a range of data sources to compile this information including the Australian Bureau of Statistics, Queensland Government Statistician’s Office, Tourism Research Australia, Economy Id and the National Institute of Economic and Industry Research. While every care has been taken to ensure the content is accurate, there may be errors or omissions in it and no legal responsibility is accepted for the information.