Professional Services - Economics and Employment

Explore the Professional Services industry data which highlights its contribution to the local economy on the Sunshine Coast.

The Sunshine Coast’s Professional Services industry has emerged as a driving force behind the region’s economic growth, steadily outpacing other sectors in recent years. Since 2015, the industry’s value add has seen exponential growth. This surge underscores the strategic importance of the Professional Services sector in diversifying and strengthening the local economy, as highlighted in the Sunshine Coast Regional Economic Development Strategy 2013-2033 (REDS).

The recent REDS Refresh 2023 assessed the progress of the strategy’s first 10 years and updated the framework to help the transformation continue. As well as being the fastest growing region in Australia, the Sunshine Coast economy was the fastest growing in Queensland over the last five years to 2022 (REDS 2023). The economy grew by 5.4 per cent over those five years and 8.1 per cent in the year 2021-22. Industry’s such as Professional Services was cited as a contributing factor to this rapid growth, reinforcing the importance that this sector plays in the evolving economy.

This article delves into the critical role Professional Services play in shaping the Sunshine Coast’s economic landscape. We examine the industry’s remarkable expansion, its contribution to local businesses—particularly small enterprises—and its capacity to generate higher-income jobs. By analysing recent trends, workforce demographics, and the distribution of businesses across the region, its revealed how the Professional Services industry is supporting local economic resilience and positioning itself as a key player on the state and national stages.

For local businesses, understanding these dynamics is essential to uncover potential opportunities for growth, adaptation, and long-term success. Whether it’s capitalising on emerging job markets or aligning with regional development strategies, this comprehensive analysis aims to equip you with valuable insights into the present and future of Professional Services on the Sunshine Coast.

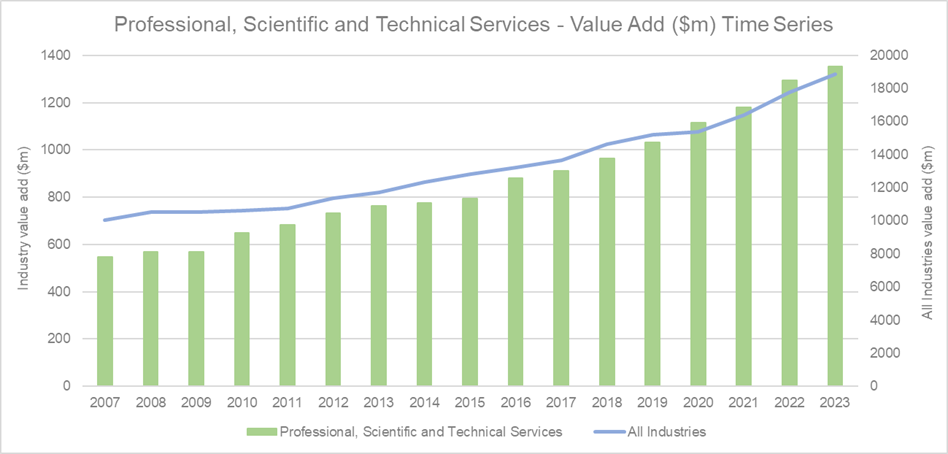

Industry productivity

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Professional Services value add has grown exponentially since 2015, surpassing all industries from 2020 onwards. The last five years has seen the industry’s value add grow by 31 per cent compared to 24.5 per cent in the previous five years. This substantial increase is an indication of the industry’s growth in the region. Professional Services is highlighted as a ‘high value’ industry in the Sunshine Coast Regional Economic Development Strategy (REDS). Since the launch of the REDS in 2013, Professional Services has been a focus industry that has supported the local economy’s diversification. ‘Value Add’ shows how productive an industry is at increasing the value of its inputs.

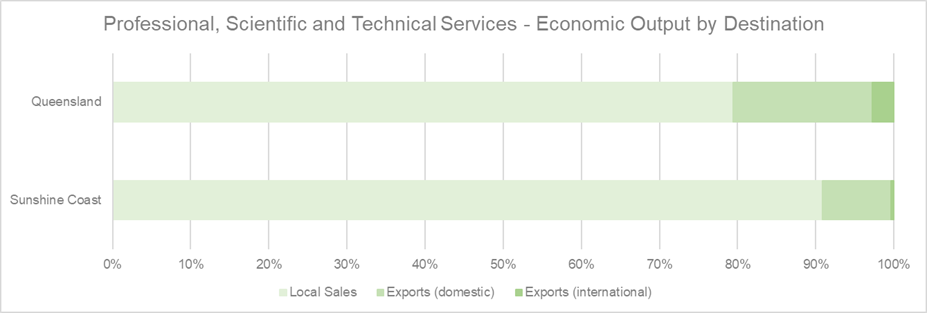

Export and local sales

(Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id)

The above table illustrates the extent to which the Sunshine Coast’s Professional Services industry caters to the local economy. Local sales account for 90.9 per cent of output for the local industry, while the remaining 9 per cent comes from outside of region. Local Professional Services play a vital role in supporting local businesses in the region. Particularly small businesses who make up 97.5 per cent of the business community on the Sunshine Coast. The REDS aims to strengthen the industry’s credibility and recognition outside of region by building capabilities of businesses in the sector.

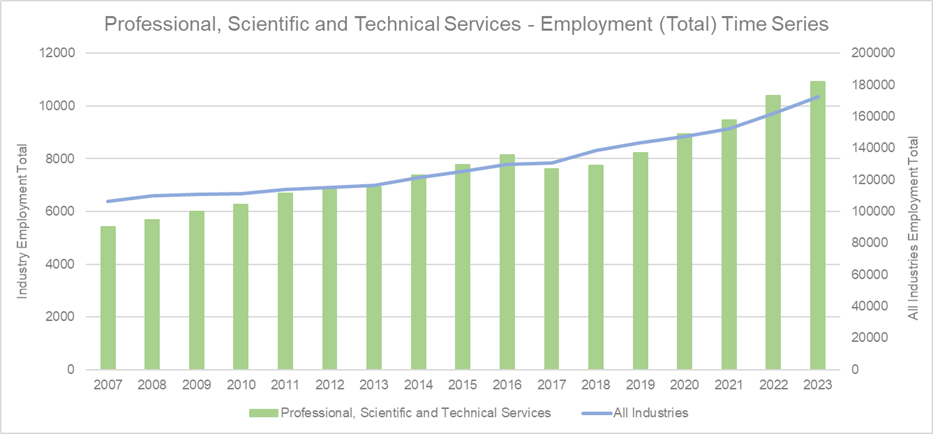

Total employment time series

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Job opportunities in Professional Services have experienced significant growth since 2017. The industry’s jobs growth is an indication of the growing number of businesses in the region and the expansion of established ones. Jobs in Professional Services has helped increase the average income of local residents as jobs in the sector are generally higher paying compared to the region’s traditional industries. The Sunshine Coast household income grew to 4.8 per cent below the state average in 2022, which is an improvement from 22.3 percent below in 2013 (REDS 2023). The target is to be on par with the state average by 2033.

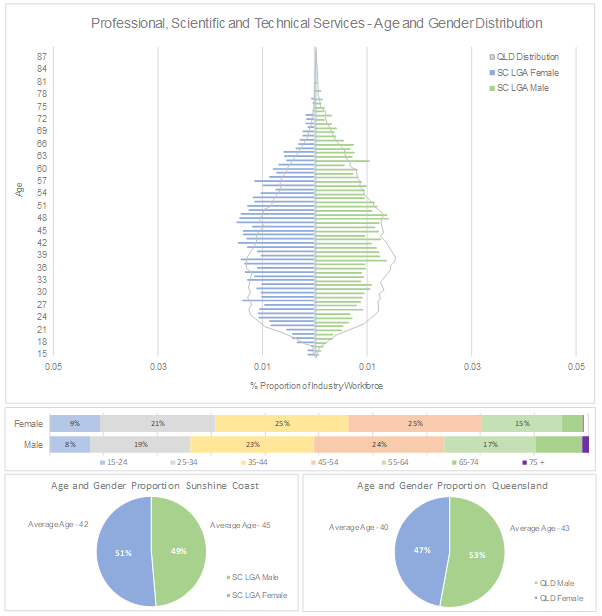

Employee age and gender distribution

(Source: ABS Table Builder 2024, 2021 Census - employment, income, and education)

The workforce age distribution indicates that half of the workforce sit within the 35 to 64 year old bracket. This may be due to younger demographics leaving the region for more career opportunities and different lifestyle. Young families and professionals seeking a new lifestyle have also moved to the Sunshine Coast adding to the midrange age bracket. As career opportunities in Professional Services grow on the Sunshine Coast, its expected that the age distribution will evolve with it.

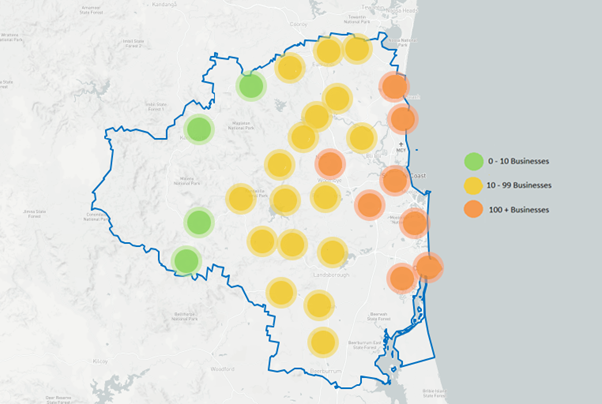

Industry business distribution

(Source: ABR 2024)

The above heatmap illustrates the vast distribution of Professional Service businesses on the Sunshine Coast. The new Maroochydore City Centre, one of Australia’s only greenfield CBD developments, is quickly becoming a hub for businesses in the sector. Industrial precincts across the coast and a new development area in Kawana is also experiencing more Professional Services businesses setting up shop to service the surrounding area. While coastal areas are still home to greater concentrations of businesses from the sector, the workplace flexibility of this profession allows for a wider spread of businesses across the suburbs and operating from homes.

Disclaimer: ABS employment Data has this information grouped by larger selected suburbs. Smaller suburbs feed into the data set of these selected suburbs.

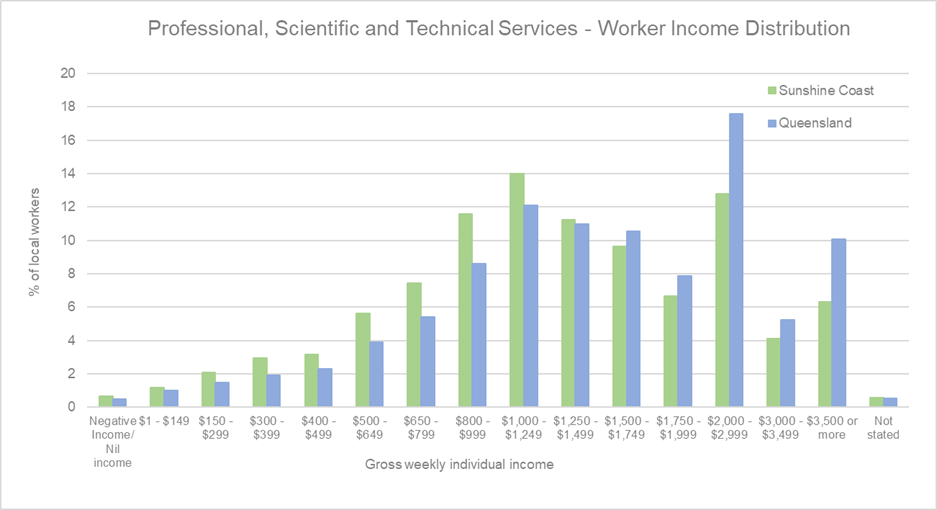

Employee income distribution

(Source: Australian Bureau of Statistics, Census of Population and Housing 2021. Compiled and presented by economy.id)

Worker income in Professional Services is considerably higher than other industry’s on the Sunshine Coast. On average across all industries, Sunshine Coast residents earn $750 per week (ABS Census 2022). In Professional Services, 64.6 per cent of the workforce receives a weekly income of $1000 which then spikes in the $2,000 - $2,999 bracket indicating the jump to senior roles. We can see that the Sunshine Coast workforce in this industry is less the state of Queensland overall.

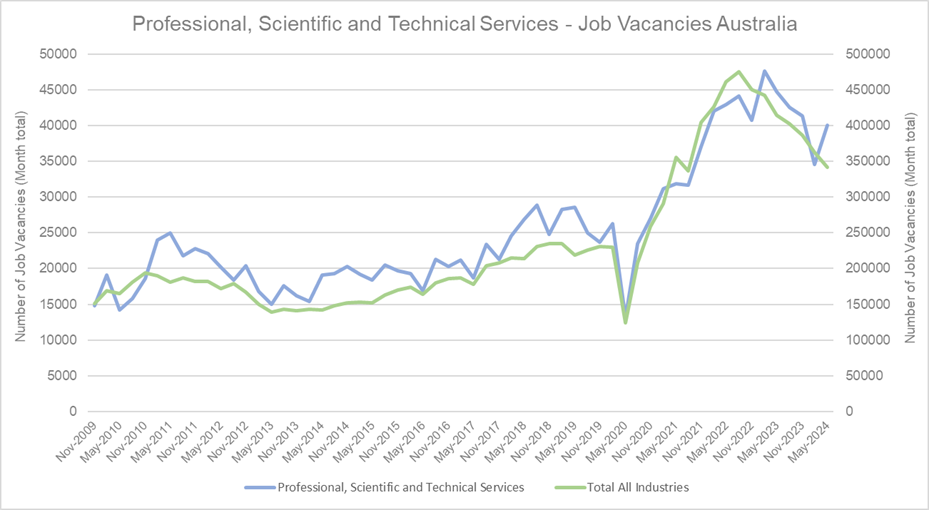

Job vacancies – Australia-wide

(Source: ABS 2024, Time Series – 6354 – Job Vacancies, Industry, Australia)

Job vacancies in Professional Services cross Australia has followed a similar trend to all total industries. In the last quarter job vacancies in the sector have spiked while other industries experienced a decline.

Conclusion

The Professional Services industry on the Sunshine Coast has proven to be a pivotal player in the region’s economic transformation, particularly in the past decade. With a significant increase in value add and job opportunities, the sector has helped bolster local businesses and income levels of the community. As a high-value industry, its growth continues to align with the REDS vision of economic diversification and strength.

While challenges remain, particularly in workforce retention and expanding recognition beyond the region, the industry’s momentum offers local businesses a wealth of opportunities. The rise in demand for professional services, coupled with ongoing regional and national trends signals an optimistic future for businesses willing to innovate, adapt, and capitalise on this growth.

For local firms, staying competitive means embracing change, building capabilities, and looking beyond local markets. By doing so, they can secure a foothold in an industry helping to reshape the Sunshine Coast economy and forge new pathways for sustainable success in the years to come.

Resources and support

- Connect with local Chambers and Industry Groups

- Sunshine Coast Jobs Hub

- Workforce Evolve

- Level Up Your Business

Disclaimer

Information contained in this correspondence is based on available information at the time of writing. All figures and diagrams are indicative only and should be referred to as such. While the Sunshine Coast Regional Council has exercised reasonable care in preparing this information it does not warrant or represent that it is accurate or complete. Council, its officers, and contractors accept no responsibility for any loss occasioned to any person acting or refraining from acting in reliance upon any material contained in this document. Any forecasts or projections used in the analysis can be affected by a number of unforeseen variables, and as such no warranty is given that a particular set of results will in fact be achieved. Sunshine Coast Regional Council has referenced a range of data sources to compile this information including the Australian Bureau of Statistics, Queensland Government Statistician’s Office, Tourism Research Australia, Economy Id and the National Institute of Economic and Industry Research. While every care has been taken to ensure the content is accurate, there may be errors or omissions in it and no legal responsibility is accepted for the information.