Retail Trade - Economics and Employment

Explore the Retail Trade industry data which highlights its contribution to the local economy on the Sunshine Coast.

The Sunshine Coast’s Retail Trade industry has played a vital role in the region’s economy for decades. Local retail has significantly contributed to the visitor offering in this iconic holiday destination and has provided for Sunshine Coast residents. As well as offer long-term jobs, retail has been a starting point for many locals entering the workforce.

The Retail Trade industry is a direct beneficiary of the emphasis that the Sunshine Coast Regional Economic Development Strategy (2013-2033) places on building a strong visitor economy and place based economy. Building of a strong visitor economy ensures that the region’s offering continues to grow, while cementing a bright Place Based Economy improves the attractiveness of our retail precincts.

Data sourced from the Australian Bureau of Statistics (ABS) and the National Institute of Economic and Industry Research (NEIR) delves into insights such as industry productivity, economic output and employment. This helps to paint the picture of manufacturing on the Sunshine Coast. By focusing on these measures, stakeholders can gain valuable insights into the current position and industry trends while understanding the broader economic landscape.

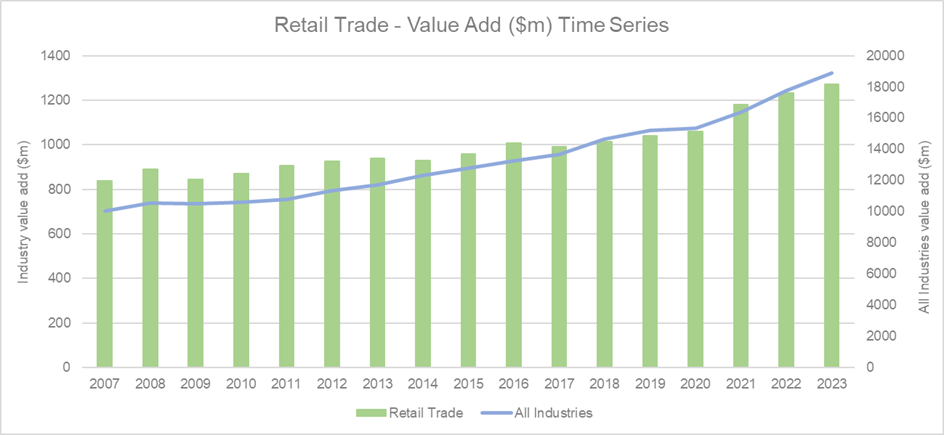

Industry productivity

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Retail Trade bounced back strong in 2021 with the Brisbane drive market venturing to the region while travelling interstate and internationally was off limits. The influx resulted in increased industry productivity jumping from $1059 million in 2020 to $1179 million in 2021. Growth has increased year-on-year since, reaching its highest ever peak in 2023 of $1272 million. ‘Value Add’ shows how productive an industry is at increasing the value of its inputs.

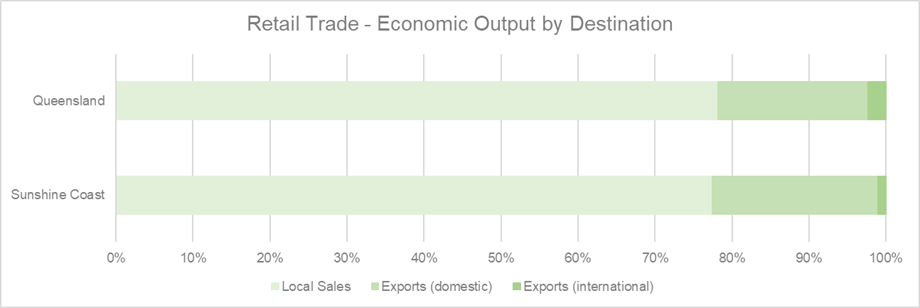

Export and local sales

(Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id)

Similar to wider Queensland, Retail Trade on the Sunshine Coast sees 77.4 per cent of its output sold to local residents. Visitors to the region and interregional online customers consume 21.5 per cent of the local retail trade’s output. As a recognised holiday destination in Australia, the Sunshine Coast’s domestic export for retail is slightly higher than Queensland’s 19.4 per cent. While international markets consume just 1 per cent of Sunshine Coast retail trade outputs.

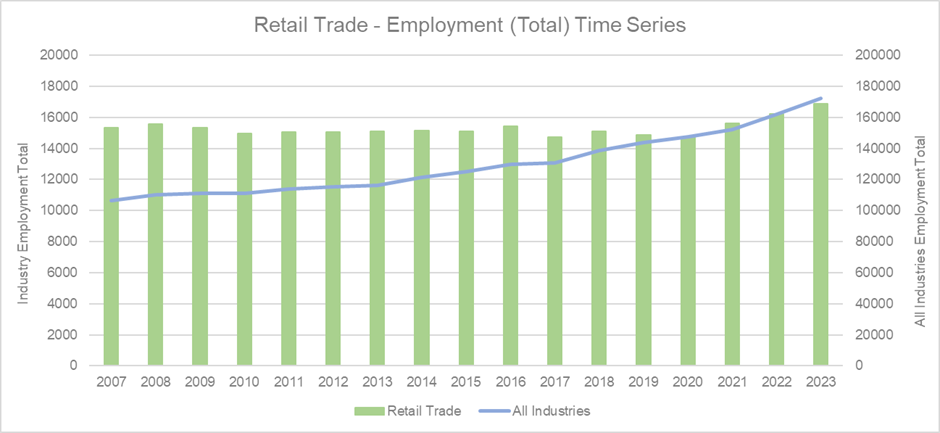

Total employment time series

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Retail employment reached its highest peak in 2023 reaching a 16,900 people workforce. This follows the 2020 slump where employment dropped to its lowest point in recent times where the workforce dropped to 14,743 people. Retail trade has traditionally been a high employing industry for the Sunshine Coast with the region being a popular holiday destination. The local economy’s diversification and growth in high-value industries has seen more job opportunities become available outside of the traditional employing sectors such as retail.

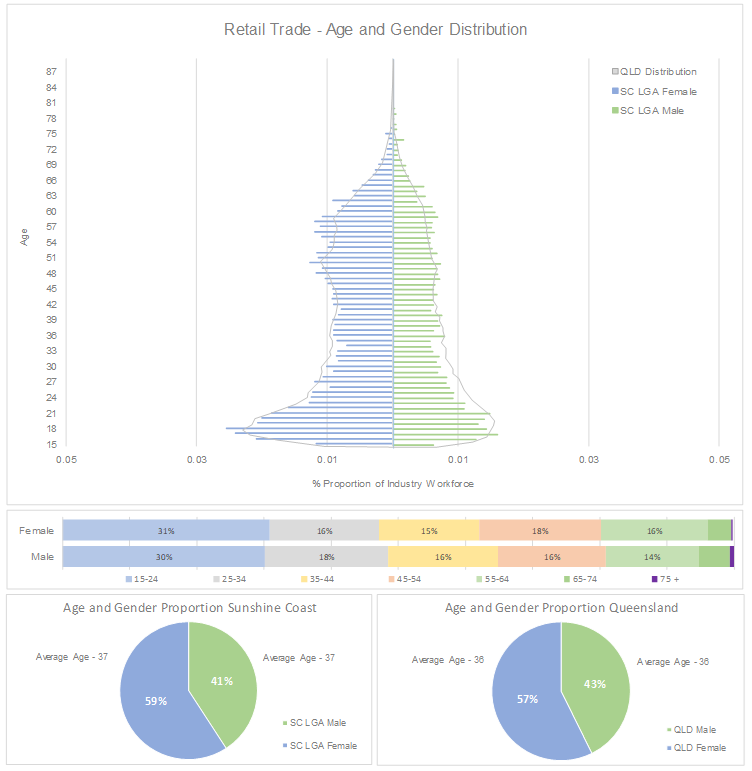

Employee age and gender distribution

(Source: ABS Table Builder 2024, 2021 Census - employment, income, and education)

Employment data indicates that females make up majority of the retail workforce with 59 per cent. Majority of the workforce sits within the 15- to 24-year-old age bracket indicating that the industry is supported by casual high school students and employees in early stages of their career. The Sunshine Coast is in line with Queensland’s distribution, also pegging the average employee age at 36.

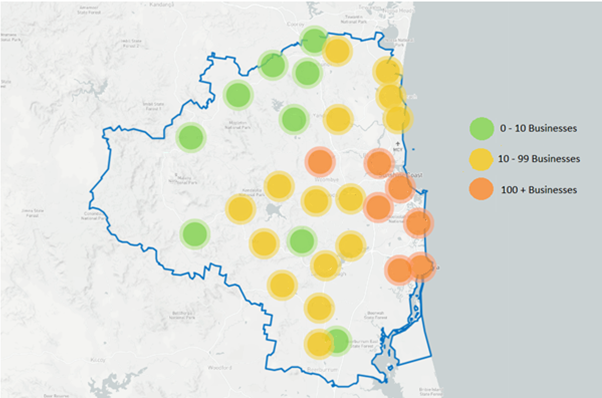

Industry business distribution

(Source: ABR 2024)

The above heat map indicates that retail businesses are concentrated in the densely populated regions of the Sunshine Coast. Caloundra to Maroochydore retain majority of retail businesses in the region.

Disclaimer: ABS employment Data has this information grouped by larger selected suburbs. Smaller suburbs feed into the data set of these selected suburbs.

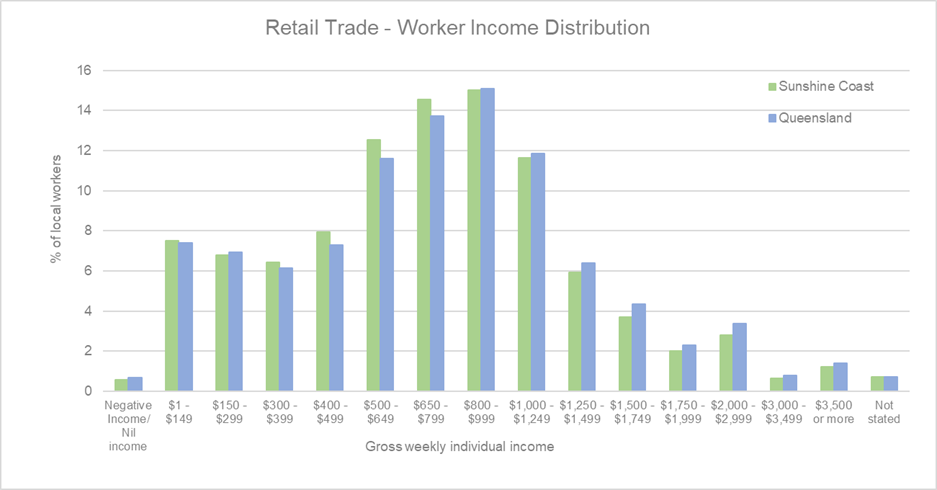

Employee income distribution

(Source: Australian Bureau of Statistics, Census of Population and Housing 2021. Compiled and presented by economy.id)

Worker income in retail trade sits around the broader Sunshine Coast average of $750 per week (ABS Census). In comparison to the state of Queensland, the Sunshine Coast’s retail income distribution is lower with the largest percentage of workers earning up to $999 per week.

Job vacancies – Australia-wide

(Source: ABS 2024, Time Series – 6354 – Job Vacancies, Industry, Australia)

Job vacancies in retail across Australia has seen large fluctuations since 2020. The resurgence of the industry since lockdowns saw job vacancies rise sharply in late 2021 to early 2022. International travel reopening provided more available workforce to fill jobs in an industry that relies heavily on casual staff.

Conclusion

The retail trade sector on the Sunshine Coast exhibits a dynamic and multifaceted landscape. The analysis highlights the productivity levels within the industry, underscored by the balance of export and local sales. Employment figures reflect a significant contribution to the region's workforce, with diverse employer demographics in terms of age and gender.

The distribution of businesses across the industry points to a varied and adaptable market structure, catering to the needs of the local community while also leveraging broader economic opportunities. The sector on Sunshine Coast is a vital component of the region’s economy that’s characterised by its resilience and adaptability. Future strategies aimed at fostering growth and addressing emerging challenges are crucial in sustaining the sector's momentum and ensuring its continued contribution to the region's economic prosperity.

Resources and support

- Connect with local Chambers and Industry Groups

- Sunshine Coast Jobs Hub

- Workforce Evolve

- Level Up Your Business

Disclaimer

Information contained in this correspondence is based on available information at the time of writing. All figures and diagrams are indicative only and should be referred to as such. While the Sunshine Coast Regional Council has exercised reasonable care in preparing this information it does not warrant or represent that it is accurate or complete. Council, its officers, and contractors accept no responsibility for any loss occasioned to any person acting or refraining from acting in reliance upon any material contained in this document. Any forecasts or projections used in the analysis can be affected by a number of unforeseen variables, and as such no warranty is given that a particular set of results will in fact be achieved. Sunshine Coast Regional Council has referenced a range of data sources to compile this information including the Australian Bureau of Statistics, Queensland Government Statistician’s Office, Tourism Research Australia, Economy Id and the National Institute of Economic and Industry Research. While every care has been taken to ensure the content is accurate, there may be errors or omissions in it and no legal responsibility is accepted for the information.