Wholesale Trade Industry - Economics and Employment

Explore the sector's economic data which highlights the contribution to the local economy on the Sunshine Coast.

The Wholesale Trade Industry is a vital component of the Sunshine Coast’s economic framework, serving as a key link between producers and consumers across a wide range of sectors. As the region continues to evolve, understanding the current state of this industry is valuable for informed decision-making and strategic planning. This article provides a snapshot of the sector’s performance, workforce characteristics, and business landscape, offering valuable insights for industry stakeholders, policymakers, and the broader community.

Guided by the Sunshine Coast Regional Economic Development Strategy (REDS), the region is committed to fostering a resilient, innovative, and inclusive economy. The REDS outlines a clear vision for sustainable growth, with a strong emphasis on workforce development, business support, and market expansion. Within this context, the Wholesale Trade Industry plays a crucial role in driving economic activity and supporting supply chain efficiency.

By examining key trends and emerging opportunities, this article aims to help industry participants better understand where the sector currently stands and how it can continue to adapt and thrive in a changing economic environment.

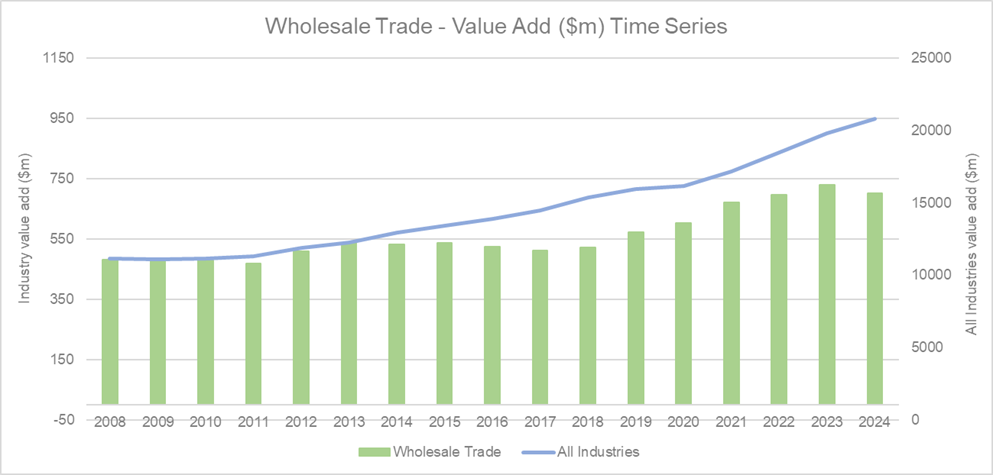

Industry productivity

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

The Wholesale Trade Industry on the Sunshine Coast contributes approximately 3.4 per cent of the total value added by all industries, underscoring its role as a key component of the regional economy. However, the sector experienced a modest contraction, with a -4.0 per cent decrease in value added from 2023 to 2024. Despite this decline, the graph indicates that the industry’s value add remained relatively stable in absolute terms. This suggests that while the sector faced some headwinds, it has maintained a steady presence within the broader economic landscape. The continued upward trend in total value added across all industries highlights a resilient regional economy, within which the Wholesale Trade sector remains a consistent contributor. Strategic focus on innovation and supply chain efficiency could help reverse the recent downturn and support future growth.

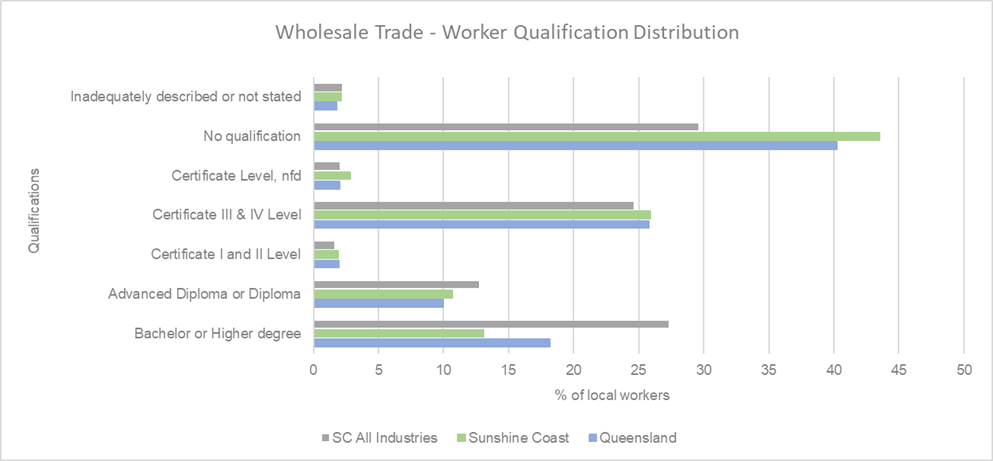

Industry workers qualifications

Source: Australian Bureau of Statistics, Census of Population and Housing 2021. Compiled and presented by economy.id)

The qualifications profile of workers in the Wholesale Trade Industry on the Sunshine Coast reveals a diverse range of educational backgrounds, with a notable concentration in vocational training. Certificate III and IV qualifications represent the largest share of the workforce, significantly higher than both the Sunshine Coast average across all industries and the Queensland average. This suggests a strong reliance on practical, skills-based training within the sector. The proportion of workers holding a Bachelor or Higher Degree is comparatively lower, indicating that higher education is less prevalent in this industry. The percentage of workers with no formal qualifications is also slightly above the regional average, highlighting potential opportunities for targeted upskilling initiatives. These trends align with the Sunshine Coast Regional Economic Development Strategy (REDS), which emphasises the importance of workforce development to support economic resilience and adaptability. By investing in education and training pathways, the region can enhance productivity and ensure the Wholesale Trade sector remains competitive in a rapidly evolving economic landscape.

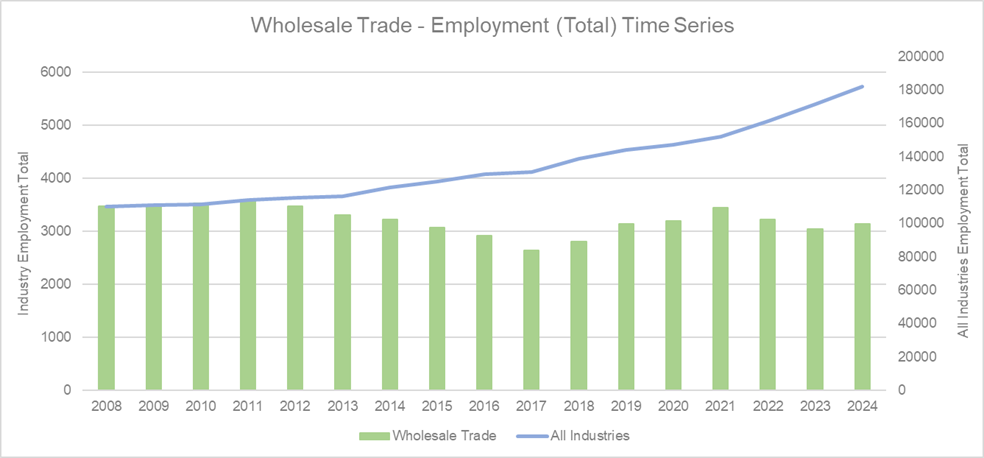

Total employment time series

Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id

Employment in the Wholesale Trade Industry on the Sunshine Coast accounts for approximately 1.7 per cent of total regional employment, indicating a modest but stable role in the local labour market. From 2021 to 2023, the industry experienced a steady decline in employment, reflecting broader economic pressures or structural adjustments within the sector. This trend reversed slightly in 2024, with a 3.0 per cent increase in total employment, suggesting early signs of recovery. This recent growth may be attributed to renewed business confidence, supply chain adjustments, or increased demand for wholesale services. While the overall employment level remains below earlier peaks, the upward shift in 2024 is a positive indicator for the sector’s resilience and potential for future workforce expansion. Continued support through workforce development and strategic investment, as outlined in the REDS, will be essential to sustaining this momentum.

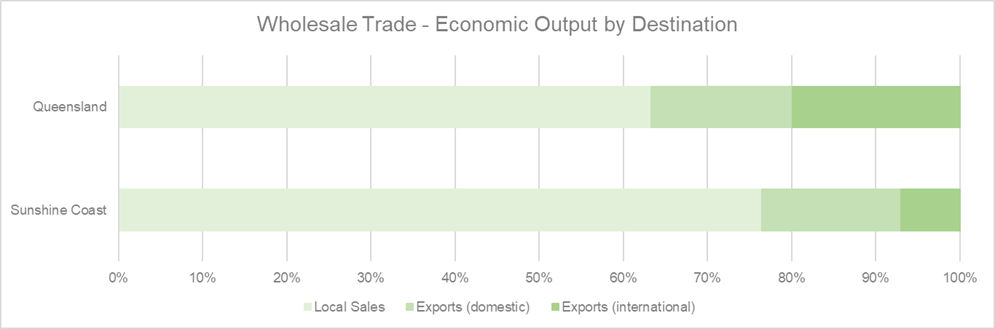

Export and local sales

(Source: National Institute of Economic and Industry Research (NIEIR) 2024. Compiled and presented by economy.id)

The Sunshine Coast’s Wholesale Trade Industry demonstrates a distinct distribution of economic output compared to Queensland overall. Local sales account for a significantly higher proportion of output on the Sunshine Coast—approximately 13.14 per cent more than the state average—highlighting the region’s strong local market orientation. Domestic exports are marginally lower by 0.23 per cent, while international exports lag more substantially, at 12.91 per cent below the Queensland average. This suggests that while the local market is a key strength for the region, there is potential to tap into expanding the industry’s reach beyond regional borders. Strategic initiatives aimed at enhancing export capabilities, as outlined in the REDS, could help the sector diversify its market base, improve economic resilience, and unlock new growth opportunities.

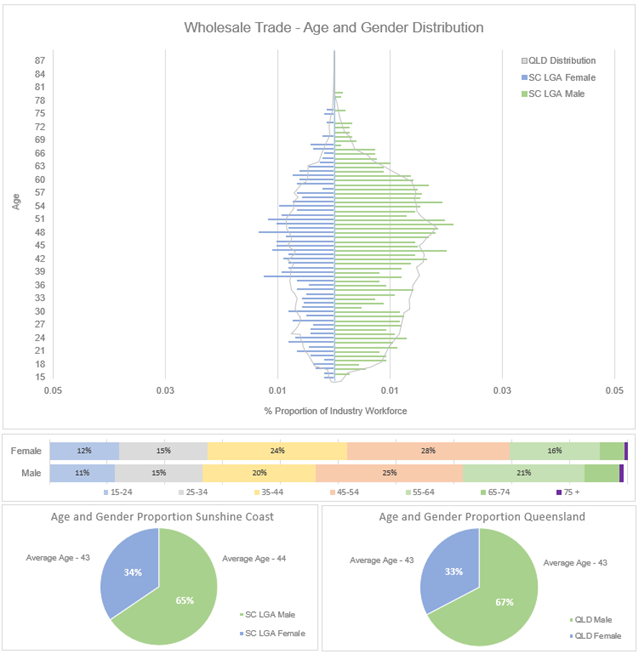

Employee age and gender distribution

(Source: ABS Table Builder 2025, 2021 Census - employment, income, and education)

The Wholesale Trade Industry on the Sunshine Coast exhibits a workforce demographic that closely mirrors state-wide trends in Queensland, with a notable skew toward female employment. Females make up approximately 65 per cent of the workforce in the Sunshine Coast Local Government Area (SC LGA), compared to 67 per cent across Queensland. Males represent 34 per cent locally and 33 per cent state-wide. The average age of workers in both regions is 43 years, indicating a mature workforce. Age distribution data shows a relatively even spread across the 25–64 age brackets, with the highest concentration in the 45–54 age group. This suggests a stable, experienced workforce, but also highlights the need for strategies to attract younger workers to ensure long-term sustainability. Addressing generational renewal and promoting gender balance through targeted recruitment and training initiatives could strengthen the sector’s resilience and adaptability in the years ahead.

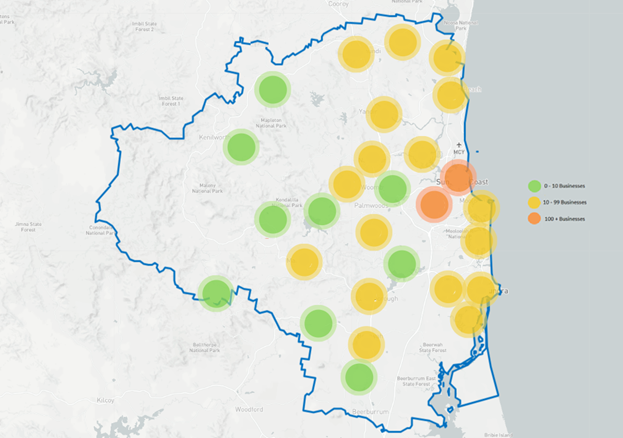

Industry business distribution

(Source: ABR 2025)

The distribution of wholesale trade businesses across the Sunshine Coast reveals a varied but strategically concentrated presence. Most regions show a moderate density of businesses, represented by yellow markers indicating between 10 and 99 businesses per area. This suggests a widespread but balanced industry footprint across the region. A notable cluster appears in the central-eastern part of the Sunshine Coast, where an orange marker signifies a high concentration of over 100 businesses. This likely corresponds to key commercial or industrial hubs that benefit from proximity to the Sunshine Coast motorway and population centres. Scattered green markers across inland and coastal areas indicate smaller pockets of wholesale activity, reflecting the industry's adaptability to both urban and semi-rural settings. This distribution highlights the importance of regional connectivity and infrastructure in supporting the growth and accessibility of the wholesale trade sector.

Disclaimer: ABS employment Data has this information grouped by larger selected suburbs. Smaller suburbs feed into the data set of these selected suburbs.

Employee income distribution

(Source: Australian Bureau of Statistics, Census of Population and Housing 2021. Compiled and presented by economy.id)

Income distribution within the Wholesale Trade Industry on the Sunshine Coast reveals a workforce largely concentrated in the lower to mid-income brackets. Approximately 42 per cent of workers earn under $999 per week, with the largest single group—20.3 per cent—earning between $1,000 and $1,249 per week. Compared to Queensland, the Sunshine Coast has a slightly higher proportion of workers in the $400–$799 range, while Queensland leads in the $800–$1,249 and higher income brackets. This suggests that while the industry provides stable employment, there may be fewer high-earning opportunities locally. The relatively lower representation in higher income categories also points to potential challenges in attracting and retaining skilled workers. Addressing this through targeted wage growth, career development pathways, and upskilling initiatives could help improve income equity and support long-term workforce sustainability in the region.

Conclusion

The Wholesale Trade Industry on the Sunshine Coast continues to play a foundational role in supporting the region’s economic ecosystem. While it has faced recent challenges, the sector is showing signs of resilience and adaptability, with emerging opportunities for growth and innovation. The industry’s strong local market presence reflects its deep integration into the economy, yet there remains significant potential to expand its reach through enhanced export capabilities and supply chain development.

The workforce is characterised by practical, skills-based qualifications and a mature demographic profile, suggesting a stable but aging labour base. To ensure long-term sustainability, the industry must focus on attracting younger workers and fostering career pathways that align with evolving industry needs. Business activity is well distributed across the region, with key hubs supporting broader economic activity and connectivity.

Income trends indicate a need to improve wage conditions and career development opportunities, reinforcing the importance of workforce investment. By aligning with the Sunshine Coast Regional Economic Development Strategy (REDS), the Wholesale Trade Industry is well-positioned to strengthen its role in a dynamic and competitive economy. With the right support and strategic focus, the sector can continue to evolve, diversify, and contribute meaningfully to the region’s future prosperity.

Resources and support

Disclaimer

Information contained in this correspondence is based on available information at the time of writing. All figures and diagrams are indicative only and should be referred to as such. While the Sunshine Coast Regional Council has exercised reasonable care in preparing this information it does not warrant or represent that it is accurate or complete. Council, its officers, and contractors accept no responsibility for any loss occasioned to any person acting or refraining from acting in reliance upon any material contained in this document. Any forecasts or projections used in the analysis can be affected by a number of unforeseen variables, and as such no warranty is given that a particular set of results will in fact be achieved. Sunshine Coast Regional Council has referenced a range of data sources to compile this information including the Australian Bureau of Statistics, Queensland Government Statistician’s Office, Tourism Research Australia, Economy Id and the National Institute of Economic and Industry Research. While every care has been taken to ensure the content is accurate, there may be errors or omissions in it and no legal responsibility is accepted for the information.